Life gets longer

More money is needed to enjoy this future.01

Scenario

If you are under 40, you will live over 100.

You will have to live many years of income,

with pensions that will not be enough;

you certainly want to avoid a nightmare!

02

Problem

Your distant future is all on your back.

You have to be able to set aside more,

but your current income won’t allow you to.

You need multiple income streams.

Solutions

MPW / My Private Welfare

With 5 tools it accompanies you to generate new additional income. Effortlessly.

Active Income – more work revenues

Passive Income – more no work and no time revenues

Reword Income – your friends have ongoing value

Health Income – more improve earnings and avoid costs

Portfolio Income – higher performance from savings investments

Your Longevity Risk

The WEF (World Economic Forum) has long argued that life extension is the financial equivalent of Climate Change.

Governments have no means to deal with the expanding number of people who have to live on pensions. People are generally unaware that they have an individual longevity risk = that they don’t have enough money to avoid a nightmare life.

At the same time, people do not know that even private pensions run many risks for longer life. This was seen in September 2022 in the US and the UK.

People should create a Private Welfare. It takes new income to have money to set aside and the know-how to do it.

BMI accompanies anyone to build a secure future.

Example

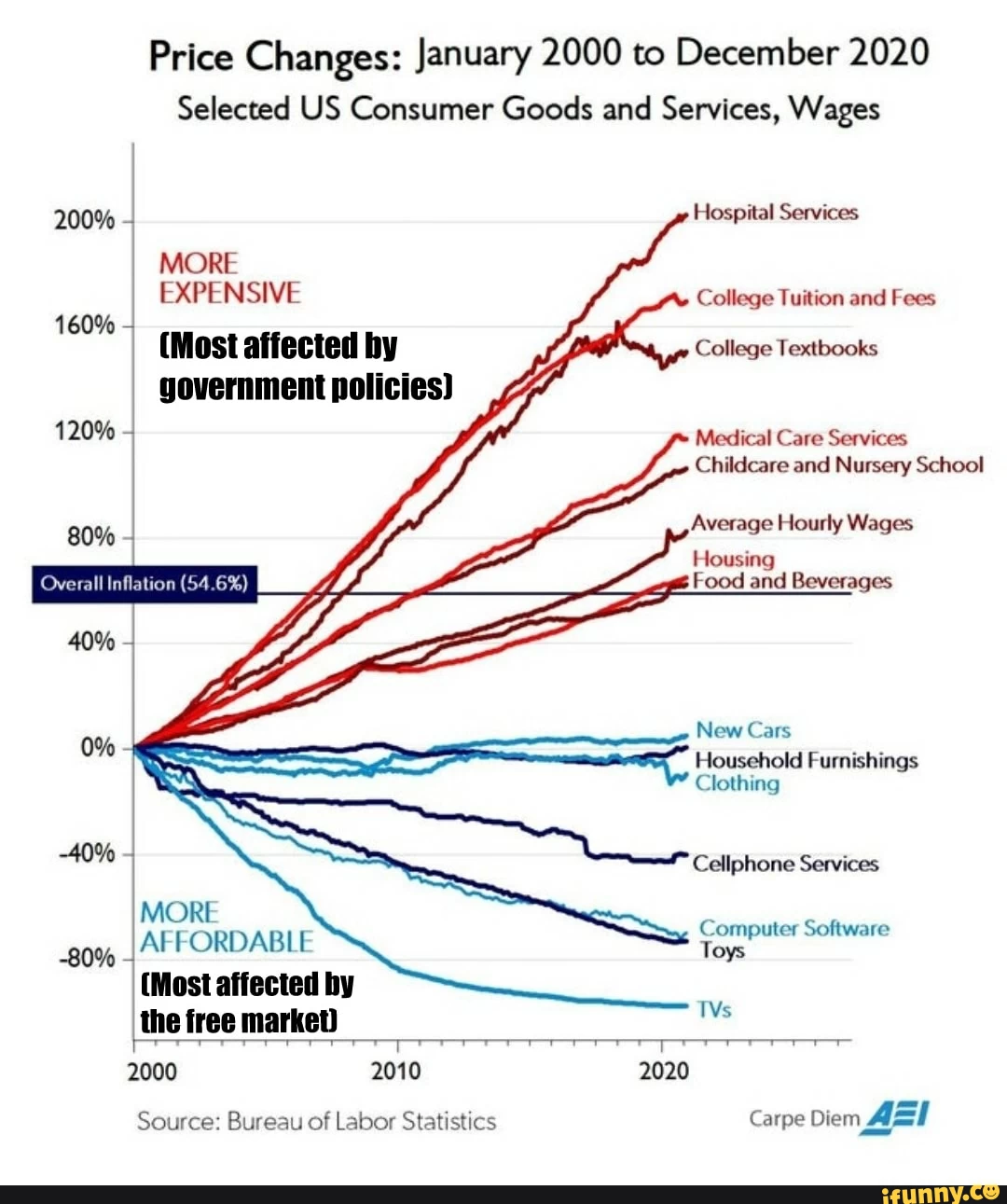

How costs change over the years